what triggers net investment income tax

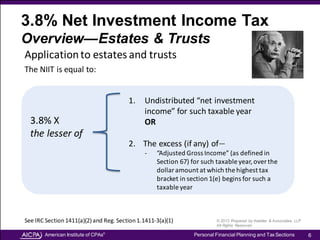

The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or the amount that your modified adjusted gross income exceeds the. What Counts as Investment Income for the NIIT.

New Brackets Net Investment Income Tax Expand Scope Of Tax Planning

In general net investment income for purpose of this tax includes but isnt limited to.

. As noted above the net investment income tax applies to an individual taxpayer only when the taxpayers MAGI exceeds a threshold amount. However it can affect any taxpayer who has a one-time increase in income. Unless the corporation can elect S status prior to the shareholders sale of stock the gain on the sale of stock is subject to net investment income tax.

It uses your MAGI modified adjusted gross income as income. Net Income Investment Tax Defined. Its net investment income and not gross investment income.

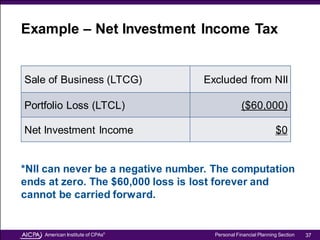

Here are a few examples of types of income that count towards the net investment income tax these are common items but the. The net investment income tax is due on the lesser of your undistributed net investment income or the portion of your MAGI that. One trick to this.

In the case of individual taxpayers section 1411a1 of the tax code imposes a tax in addition to any other tax imposed by. What triggers net investment income tax. Capital gains and qualified dividends are included in net investment income so the NIIT effectively increases the maximum tax rate on those sources of income.

The Net Investment Income Tax is imposed by section 1411 of the Internal Revenue Code. What Triggers Net Investment Income Tax. The NIIT applies at a rate of 38 to certain net investment.

The net investment income tax is due on the lesser of your undistributed net investment income or the portion of your MAGI that exceeds the thresholds. For the quarter ended September 30 2022 total pre-tax net investment income was 150 million compared to 126 million in the prior quarter. If we can increase investment expenses to lower our net income that is another way to avoid the Net Investment.

The thresholds for each type of. What Triggers Net Investment Income Tax. NIIT is an income threshold-based tax.

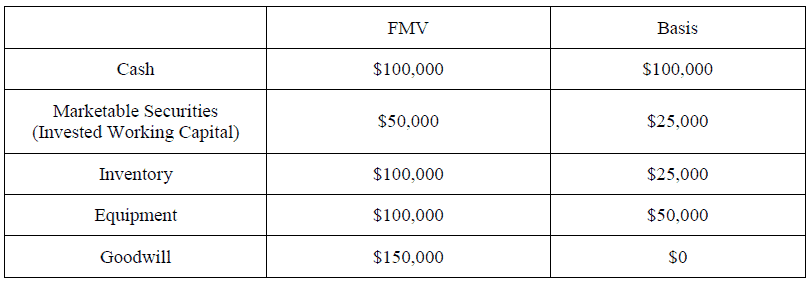

The net income investment tax NIIT is a 38 tax applied to rental property income and capital gains once certain income thresholds are met depending on your filing. Definition of Net Investment Income and Modified Adjusted Gross Income. During the quarter ended.

NIIT income must be passive. For instance selling an investment property shares of stock or a business or converting a.

How Is The Net Investment Income Tax Niit Calculated

Everything You Need To Know About Net Investment Income Niit

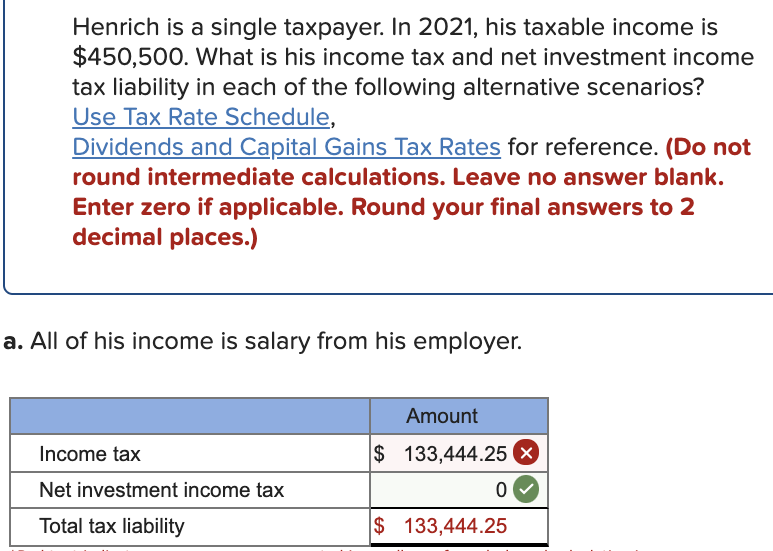

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

Taxpayers That Paid The Net Investment Income Tax Or The Additional Medicare Tax Should Consider Filing Protective Claims For Refund Mccarter English Llp

Avoiding The 3 8 Net Investment Income Tax Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Chapter 14 The Obamacare Net Investment Income Tax Pure Double Taxation Of Americansabroad Citizenship Taxation Theory Vs Reality

Capital Gains Tax Vs Net Investment Income Tax The Motley Fool

Explore The New Irs Form For Net Investment Income Tax

Plan Ahead For The 3 8 Net Investment Income Tax Mauldin Jenkins

Net Investment Income Tax And How To Avoid It Go Curry Cracker

Understanding The Net Investment Income Tax

Net Investment Income Tax In Powerpoint And Google Slides Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

How The Net Investment Income Tax Can Bite Your Clients And How To Get Them Prepared

As Tax Changes Brew In Congress Outlook Is Grim For Pass Through Owners

How Are Capital Gains Taxed Tax Policy Center

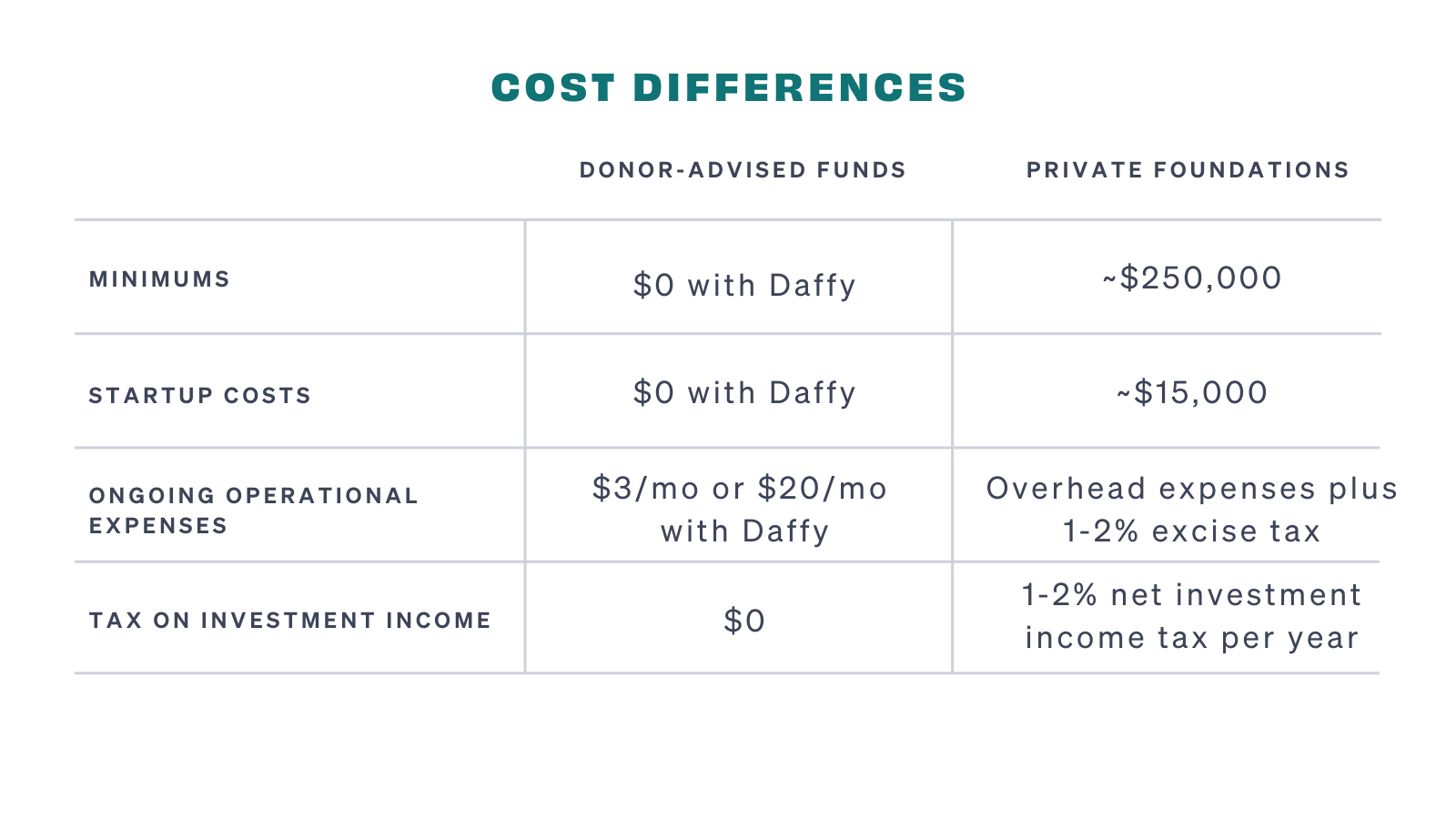

Donor Advised Funds Vs Private Foundations What S Best

The Thursday Report 10 13 16 Medicare Tax Morrow On 2704 And More Gassman Crotty Denicolo P A