owners draw report in quickbooks online

Or pick the transaction click on the Record as switch option and set the Transfer account to Owners Equity. A members draw similarly called an owners draw or partners draw records the amount taken out of a company by one of its owners.

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

We also show how to record both contributions of capita.

. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the owners equity in the business. Fill in the check fields. To record an owner contribution in Quickbooks launch the Quickbooks program and click the Banking tab at the top of the home screen.

In the drop-down of Account type you. If youre the business owner and want to record an owners draw youll basically want to write the check out to yourself like you are paying yourself with a check. Set up and Process an Owners Draw Account.

At the upper side of the page you need to press to New option. Then click on the Gear icon at the top. How to Create an Equity Account Step-by-Step Procedure To begin open the QuickBooks Online software.

Category Type Equity. Before you can register a capital investment you must set up an equity account. Set up an equity account.

Corporations should be using a liability account and not equity. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. Open the chart of accounts use run report on that account from the drop down arrow far right of the account name.

2 Create an equity account and categorize as Owners Draw. To record a transaction between the business and owners account go into the Banking menu in Quickbooks and select the option titled Write Checks. 1 Create each owner or partner as a VendorSupplier.

On the QuickBooks dashboard the home screen go to the tile called Profit and Loss. The draw is a way for an owner to receive money from the company without drawing a. Write a Check to Fund Petty Cash or a Cash Drawer.

To write a check from an owners equity account. You will setup an EFTPS Electronic Federal Tax Payment. Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to.

Enter and save the information. Hover over the net income amount in the tile at the very top. Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws.

Expenses VendorsSuppliers Choose New. Selecting the New option will bring you to the Charts of Accounts window. Help with Owner Salary or Draw Posting in QuickBooks Online.

Repay the funds from the investment. Make sure you use owners contributionsdraws equity vs. Select Chart of Account under Settings.

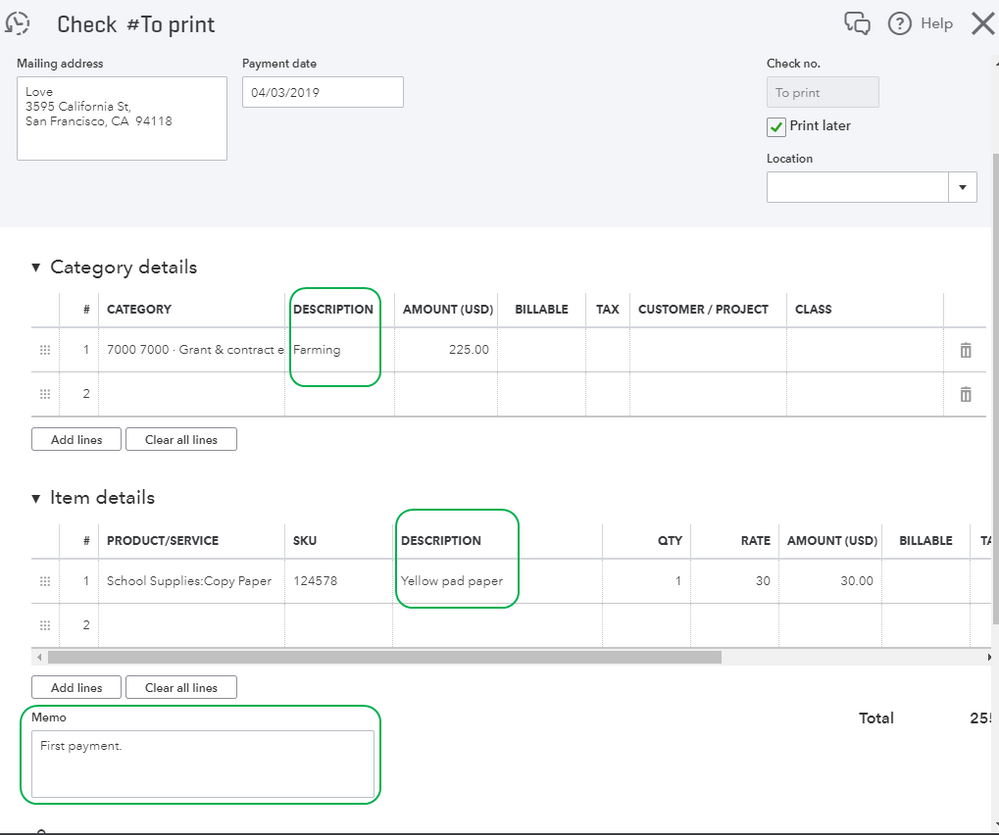

In the Account field be sure to select Owners equity you created. Select Print later if you want to print the check. You may find it on the left side of the page.

Procedure to Set up Owners Draw in QuickBooks Online The Owners draw can be setup via charts of account option. Choose the bank account where your money will be withdrawn. Select the business account used to fund the purchase.

From here choose Make Deposits and then select the bank account where youd like to deposit your personal investment. Click the net income amount. Select the Expenses tab and click the Account drop-down list.

Owners Draw because the category with GST set as Out of Scope 0. Pick the transaction click on the Categorise option pick out Expense because the transaction type myself because the SupplierCustomer and Owners Equity. For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership name Equity do not post to this account it is a summing.

Click Save Close References. To do so you are required to select the option of Chart of account at the QuickBooks online homepage and click on the feature option and now open the new tab and move to the drop-down bar of Account Type and choose the Equity option and. Heres how to put one together for use with your capital increase.

Youll notice that your cursor becomes a hand. As a business owner you are required to track each time you take money from your business profits as a draw or owner salary payment for the purpose of calculating the Estimated Quarterly Self-Employment Taxes you will owe to the IRS. The memo field is.

Click on the Account Type drop-down. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Further go to the Chart of Accounts option.

Due tofrom owner long term liability correctly. Steps to Recording an Owner Contribution in Quickbooks. Enter the total amount in the Amount column.

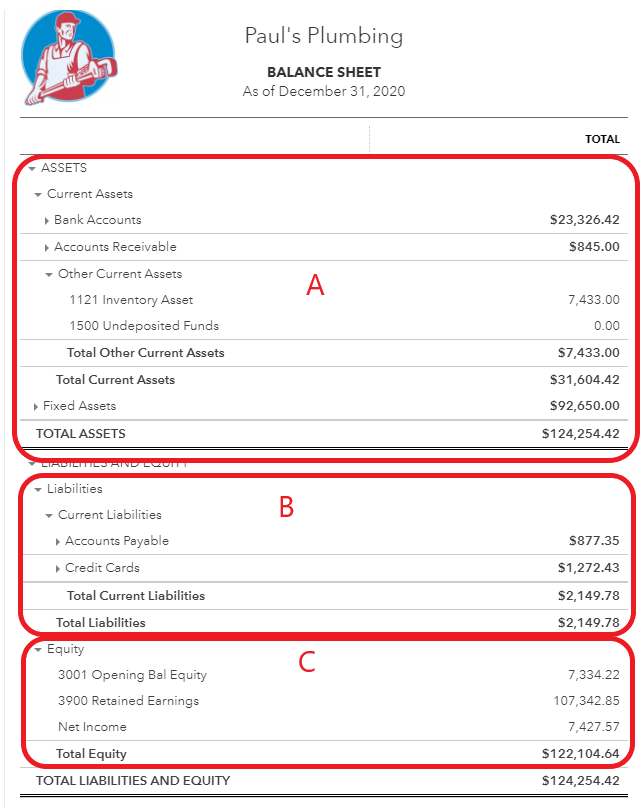

Navigate to Accounting Menu to get to the chart of accounts page. QuickBooks records the draw in an equity account that also shows the amount of the owners investment and the balance of the owners equity. Here are some steps.

Quickbooks Owner Draws Contributions Youtube

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Best 4 Quickbooks Chart Of Accounts Template You Calendars Https Www Youcalendars Com Quickbooks Cha Quickbooks Chart Of Accounts How To Use Quickbooks

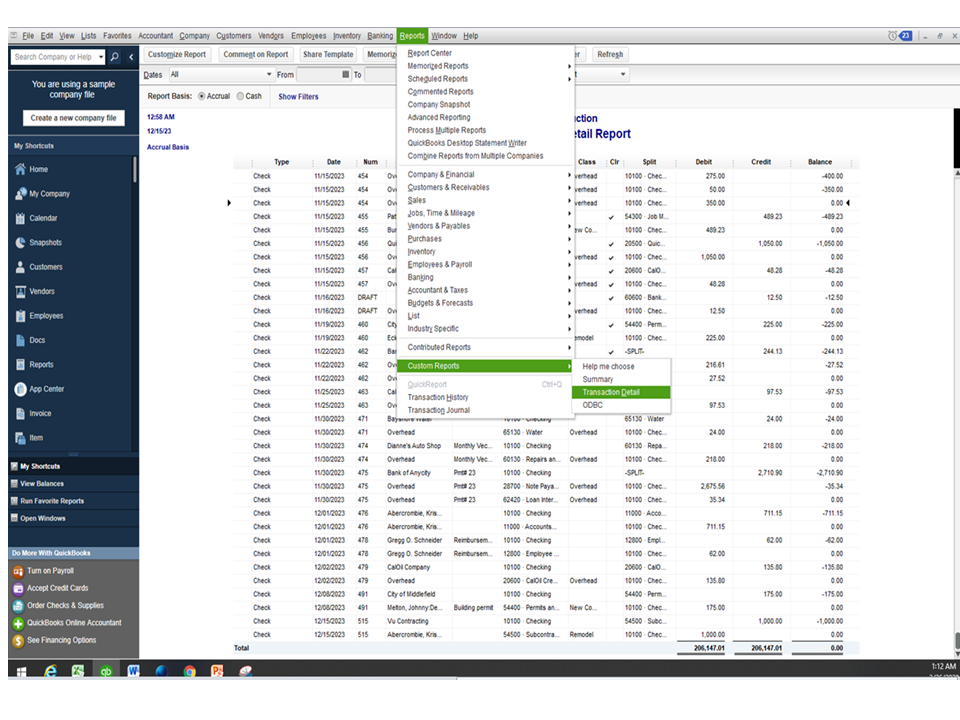

Solved How Do I Create A Custom Report For A Specific Account

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

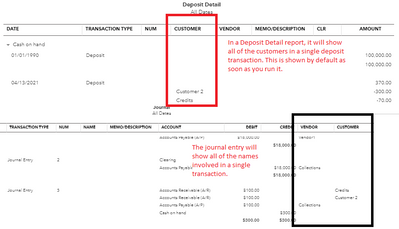

Solved How Do I Get Totals To Show Up On A Check Detail R

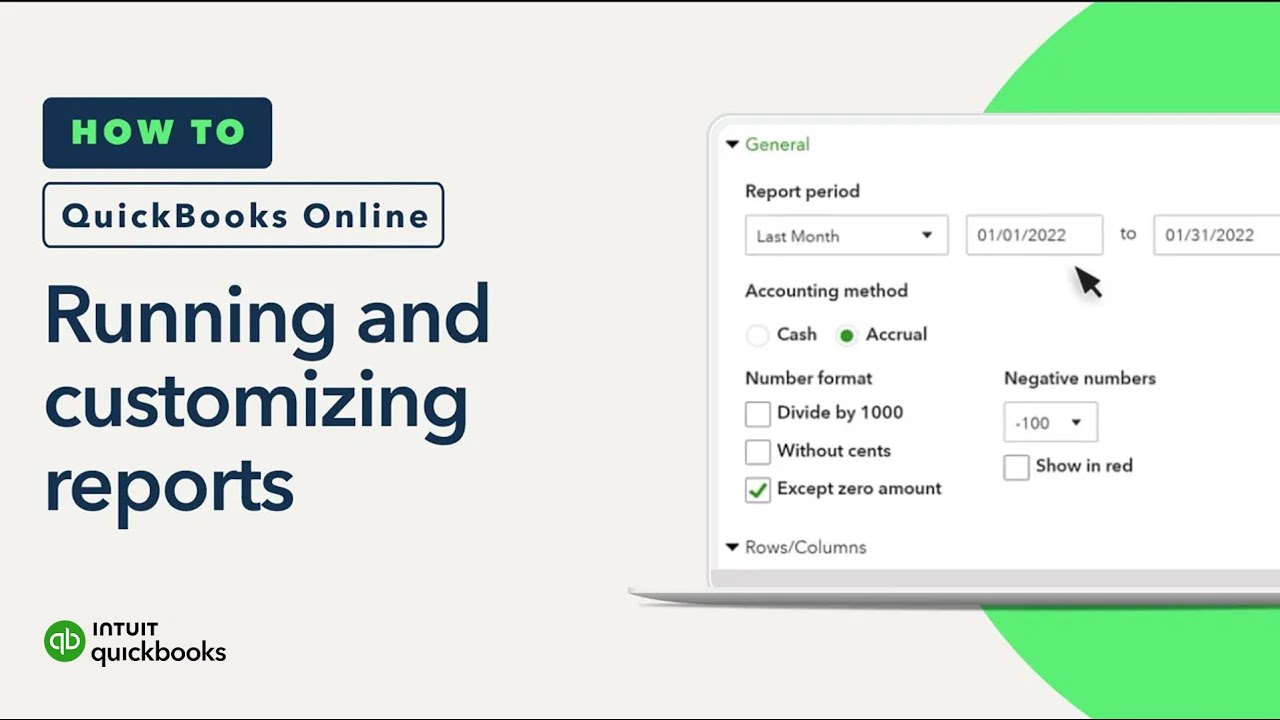

Save Custom Reports In Quickbooks Online Instructions Quickbooks Online Quickbooks Best Templates

Adding Bookkeeping To Your Virtual Assistant Services Virtual Assistant Virtual Assistant Services Bookkeeping

Solved Transaction Detail By Account Report

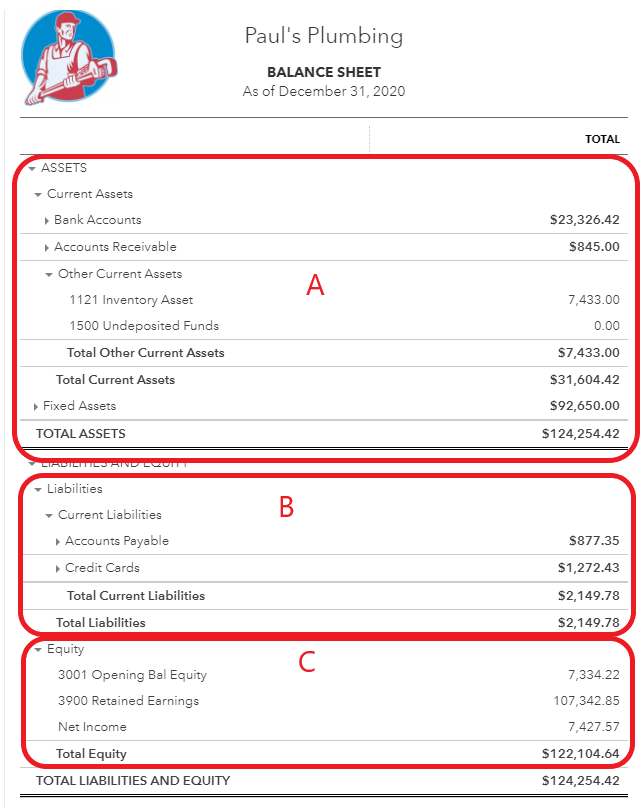

How To Create A Balance Sheet In Quickbooks Online

Solved Transaction Detail By Account Report

Quickbooks Online Tutorial Clean Up Last Year S Erroneous Balance Sheet Advanced Webinar Youtube

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

How To Run And Customize Reports In Quickbooks Online Youtube

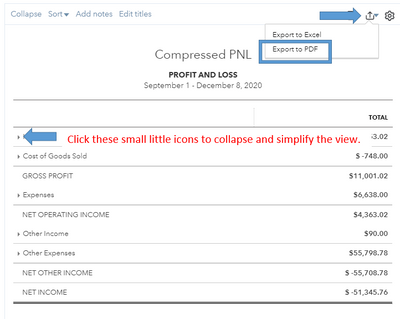

Solved Custom Profit And Loss Report

Double Entry Accounting Has Come To Freshbooks Small Business Accounting Accounting Double Entry

Quickbooks Help How To Create A Check Register Report In Quickbooks Inside Quick Book Reports Templates Great Cre Quickbooks Help Quickbooks Check Register